texas estate tax exemption

Property tax in Texas is a locally assessed and locally administered tax. In Texas the federal estate tax limits apply.

Title Tip Another Legislative Update For Texas Homeowners Candysdirt Com

In 2022 the unified credit will increase to 12060000.

. Others are accessible as additional exemptions by various public entities. 12000 from the propertys value. Property Tax Exemptions 1.

1 You must ownoccupy your home. Property tax brings in the most money of all taxes available. A disabled veteran may also qualify for an exemption of 12000 of the assessed value of the property if the veteran is age 65 or older.

While the increase itself is notable what may be more important is. Tax exemptions for residence homestead. Property tax brings in the most money of all taxes available.

Property tax in Texas is locally assessed and locally admin-istered. Property tax in Texas is a locally assessed and locally administered tax. 2022 Lifetime Estate and Gift Tax Exemption.

You may qualify for exemptions that will reduce your. Texas Tax Exemption Simple Online Application. If you want to learn more about property taxes in Texas or need a Guadalupe County property tax loan you have come to the right place.

Texas has no income taxes but it levies a franchise tax of 0375 on wholesalers and retailers. There is no state property tax. In the past year there were proposals to reduce the estate tax exemptionmeaning lowering the amount after which individuals will.

All residence homestead owners are allowed a 40000 residence homestead exemption from their homes value for school district taxes. Applications for property tax exemptions are filed with the appraisal district in which the property is located. As per Texas Property Tax Code 1113b school districts can offer a 25000 tax exemption on residence homesteads.

There is no state property tax. Certain exemptions like the Homestead Exemption must be offered invariably throughout Texas. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Ad Step-By-Step Guides to Help Administer the Estate and Avoid Tax Penalties. Other Property Tax Exemptions in Texas. The exemption will be added to the existing 25000 homestead exemption.

Property tax brings in the most money of all taxes available. Although they are not common there are a few other Texas property tax exemptions that might apply to your situation. Property tax in Texas is locally assessed and locally admin-istered.

2 Your home must be located in Texas. SENIOR TAX EXEMPTION. A Except as provided by Subsections b and c of this section property owned by this state or a political subdivision.

This rate can go up to 075 for non. Ad Texas Tax Exemption Wholesale License Reseller Permit Businesses Registration. There is no state property tax.

There is no state property tax. The Breakdown of Taxes in Texas. Property tax in Texas is a locally assessed and locally administered tax.

Step-By-Step Guides to Avoid Tax Penalties and Close the Estate Effectively. There is no state property tax. If you are a senior.

Eligible seniors will get a 10000 exemption for school district property taxes. Property Tax Exemptions 1. Before applying for either you must first meet the following criteria.

Reduction to the Estate Tax Exemption. If you own a ranch and you are age 65 or older you qualify for this exemption as long as you live in a house on the property. In addition to the 25000 exemption for homeowners seniors or disabled homeowners qualify for a 10000 homestead exemption for school taxes.

In 2018 the thresholds for a single persons Texas estate tax were estimated to be 58 million and 112 million for a married. Exemptions from property tax require applications in most circumstances. Fisher Investments has 40 years of helping thousands of investors and their families.

3 You must be a.

Qualifying Trusts For Property Tax Homestead Exemption Sprouse Shrader Smith

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

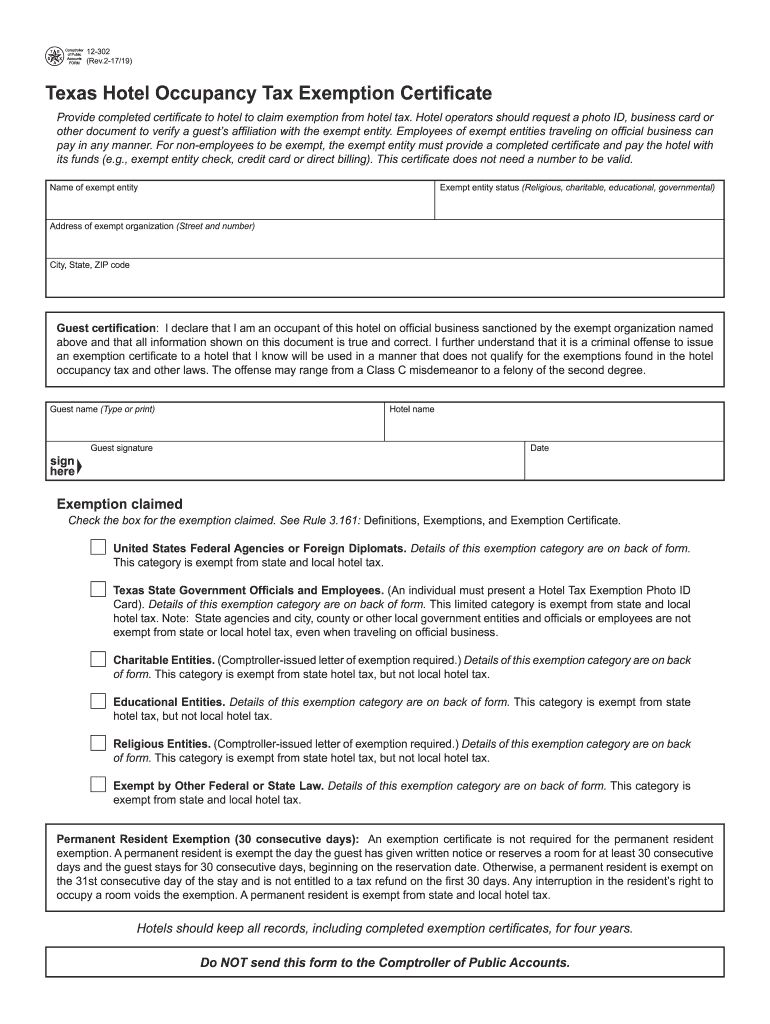

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

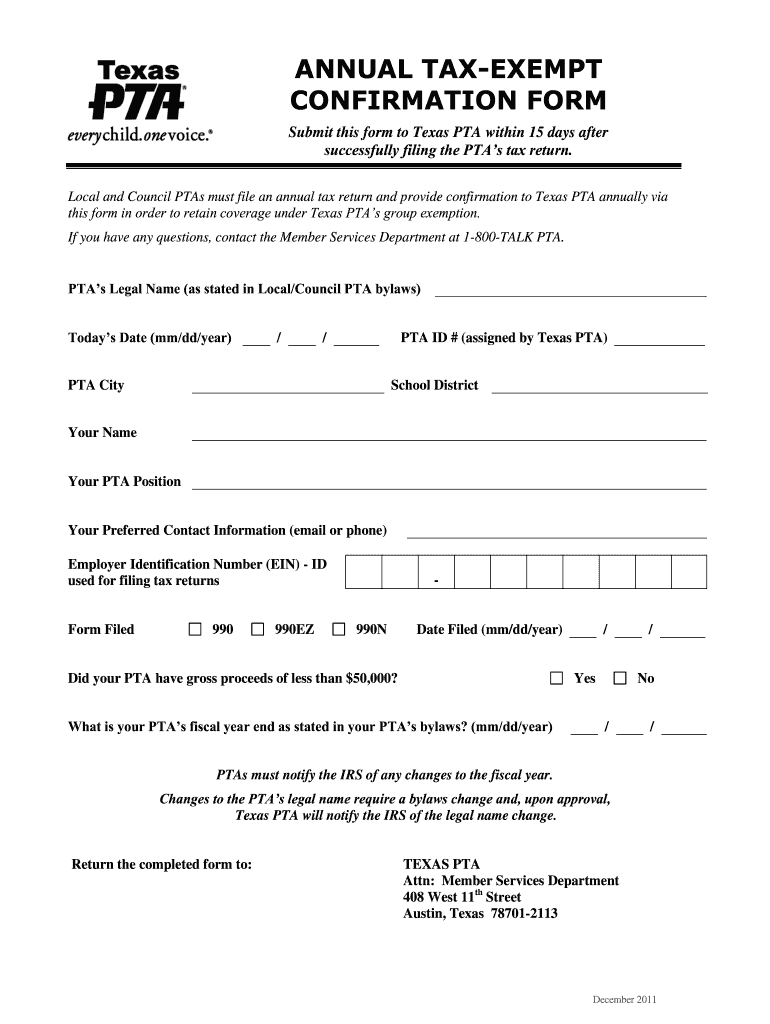

Free Form 01 339 Texas Sales And Use Tax Exemption Certification Free Legal Forms Laws Com

Texas Homestead Tax Exemption Cedar Park Texas Living

Over 65 Property Tax Exemption In Texas

Is There An Inheritance Tax In Texas

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Tax Exempt Certificate Fill And Sign Printable Template Online Us Legal Forms

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Tx Comptroller 12 302 2017 2022 Fill Out Tax Template Online Us Legal Forms

Texas Inheritance And Estate Taxes Ibekwe Law

Tx Comptroller 01 315 1991 2022 Fill Out Tax Template Online Us Legal Forms

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

/https://static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG)

Property Tax Relief Available To Texas Homeowners Through Homestead Exemptions The Texas Tribune

State Tax Exemption Form Fill Out And Sign Printable Pdf Template Signnow